What Taxes do Restaurants Pay in Uzbekistan? | Complete Guide and Rates

Running a restaurant in Uzbekistan comes with a variety of tax obligations that every owner must understand to stay compliant and maintain profitability. From corporate income tax to value-added tax (VAT), payroll taxes, and local municipal fees, understanding the taxation landscape is crucial for restaurant operators.

The tax system in Uzbekistan is structured to support businesses, but non-compliance can lead to significant fines and operational challenges. Whether you’re launching a new restaurant or managing an existing one, having a clear grasp of the taxes you must pay will help you plan your finances, price your menu correctly, and avoid unnecessary penalties.

In this guide, we’ll break down the key taxes that apply to restaurants in Uzbekistan, including:

- Corporate taxes – How much businesses must pay and which tax structures are available.

- VAT for restaurants – What the rates are and how to calculate it.

- Payroll and employee taxes – What deductions and contributions employers must make.

- Local municipal taxes – Additional fees like property taxes, signage fees, and licensing costs.

- Excise taxes on alcohol and tobacco – Important tax obligations for restaurants serving these products.

- Tax incentives – Opportunities to reduce tax burdens legally.

By the end of this guide, you’ll have a complete understanding of how to handle restaurant taxes in Uzbekistan, ensuring smooth operations and financial stability.

Overview of Restaurant Taxes in Uzbekistan

Taxation is a critical aspect of running a restaurant in Uzbekistan, affecting everything from pricing strategies to profitability. The country’s tax system includes several mandatory payments for restaurant owners, ranging from corporate taxes to value-added tax (VAT), payroll deductions, and local municipal fees. Understanding these taxes ensures compliance with government regulations while helping restaurants optimize their financial operations.

Key Government Authorities Regulating Restaurant Taxes

In Uzbekistan, multiple government agencies oversee taxation for businesses, including restaurants. These authorities ensure tax compliance, collect revenue, and impose penalties for violations. The main institutions include:

- State Tax Committee of Uzbekistan – The primary authority responsible for corporate taxes, VAT, and payroll taxation.

- State Customs Committee – Manages import duties and excise taxes for goods brought into the country, such as food ingredients and kitchen equipment.

- Local Municipal Administrations – Oversee regional taxes, property taxes, and business licensing fees.

- Pension Fund & Social Protection Agencies – Manage social security contributions deducted from employee salaries.

Restaurant owners must stay updated on regulations from these agencies to avoid penalties and benefit from available tax incentives.

Types of Taxes Restaurants Must Pay

Restaurants in Uzbekistan are subject to various taxes, categorized into national and local obligations. These include:

National Taxes:

- Corporate Income Tax – Levied on the profits of restaurant businesses.

- Value-Added Tax (VAT) – Applied to the sale of food and beverages.

- Payroll Taxes – Includes income tax deductions and social contributions for employees.

- Excise Tax – Imposed on the sale of alcohol and tobacco products.

- Import Duties – Charged on imported ingredients, beverages, and equipment.

Local Taxes:

- Property Tax – Paid on restaurant buildings and real estate.

- Business License Fees – Required for operating legally in different municipalities.

- Advertisement and Signboard Taxes – Charges for restaurant signage and marketing displays.

Understanding these tax categories helps restaurant owners plan their finances effectively and avoid unexpected liabilities.

How Taxes Impact Restaurant Profitability

Taxes directly affect a restaurant’s revenue, pricing, and overall profitability. Business owners must account for tax obligations in their pricing models to ensure sustainable operations. Key considerations include:

- Menu pricing adjustments – Taxes like VAT must be factored into menu prices to maintain profitability.

- Labor costs – Payroll taxes and social contributions add to employee-related expenses.

- Compliance costs – Hiring accountants or tax consultants to manage tax filings can be an additional expense.

- Penalties for non-compliance – Failing to meet tax deadlines can result in fines and business disruptions.

By understanding these tax implications, restaurant owners can develop effective financial strategies to optimize profitability while remaining compliant with Uzbekistan’s tax laws.

Corporate Tax Obligations for Restaurants

All restaurants operating in Uzbekistan are required to pay corporate income tax, which is levied on business profits. Understanding the corporate tax system is crucial for restaurant owners to ensure compliance and optimize their tax liabilities. The country offers different tax regimes based on business size, revenue, and legal structure. Choosing the right tax structure can significantly impact a restaurant’s financial health.

What is the Corporate Income Tax in Uzbekistan?

Corporate income tax is applied to the net profits of a restaurant after deducting business expenses. The key aspects include:

- Corporate Tax Rate – As of recent regulations, the standard corporate income tax rate for businesses, including restaurants, is 15% on net profits.

- Calculation of Taxable Income – Restaurants must report their gross revenue and deduct allowable expenses, such as:

- Food and beverage costs

- Employee wages and benefits

- Rent and utilities

- Marketing and operational expenses

- Filing Deadlines – Corporate income tax returns must be filed annually, with advance payments required quarterly based on estimated earnings.

- Tax Penalties – Late payments or incorrect filings can lead to fines, additional interest charges, and even business restrictions.

Proper financial record-keeping and working with a tax advisor can help ensure accurate tax calculations and avoid penalties.

Small Business Tax Options for Restaurants

Small and medium-sized restaurant businesses may qualify for alternative tax regimes that simplify reporting and lower tax burdens. These include:

Simplified Tax Regime (Turnover Tax)

- Restaurants with annual revenue below a certain threshold (determined by the government) can opt for the turnover tax, a fixed percentage of gross revenue.

- This regime eliminates the need for complex corporate income tax calculations.

- The turnover tax rate is generally between 4% and 10% depending on the industry and business size.

Fixed Tax for Microbusinesses

- Restaurants with very small operations may qualify for a fixed tax system, where they pay a predetermined amount regardless of revenue.

- This is beneficial for small cafes, food stalls, and home-based catering businesses.

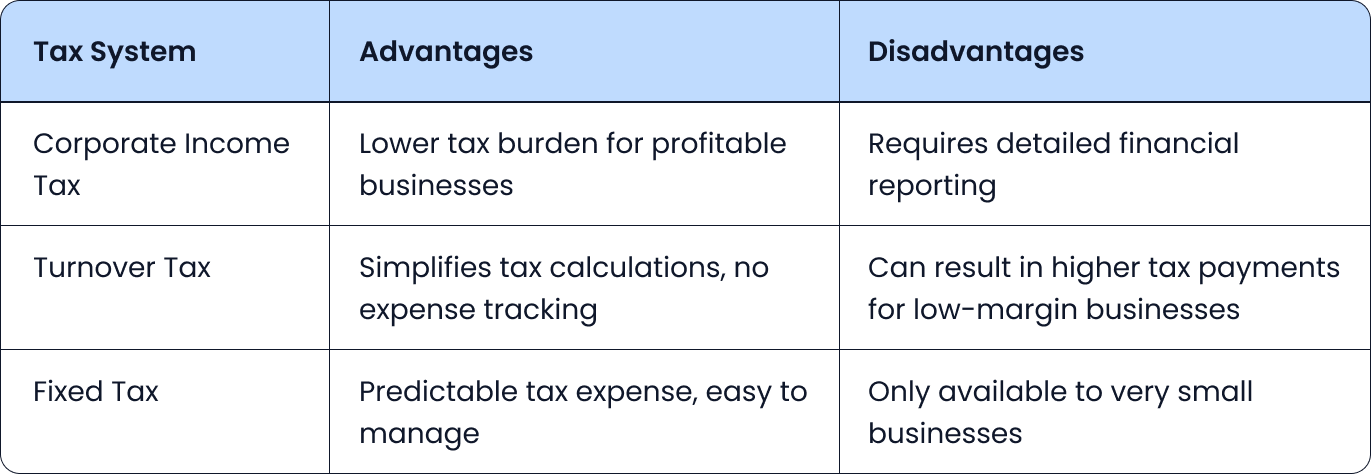

Advantages and Disadvantages of Different Tax Structures

Choosing the right tax structure can significantly impact a restaurant’s financial health.

Restaurant owners should evaluate their financial situation and consult a tax professional to determine the most beneficial tax regime.

Value-Added Tax (VAT) for Restaurants

Value-Added Tax (VAT) is a major tax obligation for restaurants in Uzbekistan. It is an indirect tax applied to the sale of food, beverages, and services, which restaurants must collect from customers and remit to the government. Understanding VAT regulations ensures compliance and helps restaurant owners manage pricing strategies effectively.

What is VAT and How Does it Apply to Restaurants?

VAT is a consumption tax that restaurants must include in their prices and later submit to tax authorities. Key points include:

- Standard VAT Rate – The current VAT rate in Uzbekistan is 12%. This applies to most goods and services, including restaurant sales.

- VAT Registration – Restaurants must register for VAT if their annual revenue exceeds 1 billion UZS (subject to periodic government revisions).

- VAT on Different Restaurant Sales:

- Dine-in and takeaway meals – Subject to 12% VAT.

- Alcohol and tobacco sales – Also subject to VAT plus excise taxes.

- Catering services – Fully VAT taxable.

How to Calculate and Report VAT?

Restaurants must correctly calculate VAT on their sales and file reports on time to avoid penalties.

Step-by-Step VAT Calculation:

- Determine VAT-inclusive price – If a dish costs 100,000 UZS before VAT, the VAT amount is:

- 100,000 UZS × 12% = 12,000 UZS

- Final price to the customer: 112,000 UZS

- Calculate VAT payable – If total monthly restaurant sales (VAT-inclusive) are 56,000,000 UZS, VAT owed is:

- (56,000,000 ÷ 1.12) × 12% = 6,000,000 UZS

VAT Filing and Payment:

- Reporting frequency – VAT returns must be filed monthly by the 20th of each month.

- Input VAT deductions – Restaurants can deduct VAT paid on:

- Ingredient purchases

- Kitchen equipment

- Utilities (if VAT applicable)

Common VAT Mistakes and How to Avoid Them

Incorrect VAT handling can lead to audits, fines, or even business restrictions. Some common mistakes include:

- Failure to register for VAT – Restaurants exceeding the revenue threshold must register on time.

- Misclassification of VAT-exempt items – Some food products may be VAT-exempt, but prepared meals are always taxable.

- Late VAT payments – Delays result in financial penalties and potential legal actions.

- Not keeping proper records – Restaurants must maintain detailed VAT invoices and receipts.

To ensure compliance, restaurant owners should use accounting software or hire a tax consultant to manage VAT obligations efficiently.

Payroll Taxes and Employee Contributions

Restaurants in Uzbekistan are required to deduct payroll taxes and make employer contributions for their employees. These taxes cover income tax, social security, and pension fund contributions. Proper payroll tax management ensures compliance with labor laws and helps avoid penalties.

Employer Responsibilities for Payroll Taxes

Restaurant owners must deduct payroll taxes from employees’ wages and contribute to state funds. The key payroll tax obligations include:

- Personal Income Tax (PIT) – Employers must withhold 12% from employees’ salaries and remit it to the government.

- Social Security Contributions –

- Employers contribute 12% of an employee’s gross salary to social security.

- Employees contribute 0.1% of their salary to social security.

- Pension Fund Contributions – A mandatory 4% employer contribution to the state pension system.

- Unemployment Insurance – Restaurants must contribute 0.5% to the unemployment insurance fund.

All deductions must be calculated on gross wages before any bonuses or overtime pay.

How to Properly Manage Payroll Taxes?

Managing payroll taxes efficiently helps restaurants avoid compliance issues. Best practices include:

1. Payroll Tax Calculation Example:

For a restaurant employee earning 5,000,000 UZS per month:

- Employee deductions:

- Personal Income Tax (12%) = 600,000 UZS

- Social Security (0.1%) = 5,000 UZS

- Employer contributions:

- Social Security (12%) = 600,000 UZS

- Pension Fund (4%) = 200,000 UZS

- Unemployment Insurance (0.5%) = 25,000 UZS

2. Payroll Tax Filing and Deadlines:

- Payroll taxes must be submitted monthly by the 15th of the following month.

- Employers must issue payslips detailing tax deductions and net pay.

3. Avoiding Payroll Tax Penalties:

- Ensure timely submission of payroll tax reports.

- Maintain accurate employee records and tax filings.

- Use payroll management software to automate tax calculations.

By properly handling payroll taxes, restaurant owners ensure legal compliance while maintaining employee trust and satisfaction.

Local and Municipal Taxes for Restaurants

In addition to national taxes like corporate income tax and VAT, restaurants in Uzbekistan must also pay various local and municipal taxes. These taxes vary by region and city, covering property tax, business licensing fees, and advertising permits. Understanding these obligations helps restaurant owners avoid unexpected costs and ensure compliance with local authorities.

What Local Taxes Do Restaurants Pay?

Local municipalities impose several taxes on restaurants to support infrastructure and city services. The key local taxes include:

1. Property Tax

- Applies to restaurant buildings and land owned by the business.

- The standard property tax rate is 2% of the cadastral value of the property.

- If the restaurant is in a leased building, the landlord typically pays this tax, but costs may be passed to tenants through rent agreements.

2. Business License Fees

- Restaurants must obtain and renew operating licenses from municipal authorities.

- Licensing fees depend on the type and size of the restaurant and may include:

- General business license for restaurant operations.

- Alcohol license (if serving alcoholic beverages).

- Outdoor seating permit for restaurants with terraces or sidewalk dining.

3. Signboard and Advertisement Tax

- A fee is charged for restaurant signage, billboards, and advertising materials visible in public spaces.

- The amount varies by city and the size of the advertisement.

- Digital advertising (such as LED billboards) may require additional permits.

Regional Variations in Local Taxes

Local tax rates and regulations can differ by city or district. Some factors influencing tax differences include:

- Major cities (Tashkent, Samarkand, Bukhara) – Higher property taxes and business license fees due to prime locations.

- Smaller towns and rural areas – Lower local taxes to encourage business investment.

- Tourist zones – Restaurants in high-tourism areas may face additional hospitality taxes or tourist fees.

How to Find Local Tax Information?

Since local taxes vary, restaurant owners should:

- Check with the local municipality office for updated tax rates and regulations.

- Consult a business tax advisor to ensure all local tax obligations are met.

- Review lease agreements to confirm responsibility for property tax payments.

By understanding and planning for local and municipal taxes, restaurant owners can budget accurately and avoid fines or operational disruptions.

Excise Taxes on Alcohol and Tobacco Sales

Restaurants and bars in Uzbekistan that sell alcoholic beverages or tobacco products must comply with excise tax regulations. Excise tax is a special consumption tax levied on goods that the government regulates due to their impact on public health and consumption behavior. This tax is applied in addition to Value-Added Tax (VAT) and is included in the final price paid by customers.

What is the Excise Tax on Alcohol in Uzbekistan?

Excise tax applies to all alcoholic beverages sold in restaurants, including beer, wine, and spirits. The key regulations include:

- Excise tax rates vary by alcohol type and alcohol content:

- Beer – Lower tax rates due to lower alcohol content.

- Wine and champagne – Moderate tax rates.

- Vodka, whiskey, rum, and other spirits – Higher excise tax due to high alcohol content.

- Alcohol excise tax is levied per liter of beverage rather than a percentage of sales price.

- Restaurants must obtain a valid alcohol license before selling alcoholic drinks.

- Invoices and receipts must separately indicate excise tax amounts for transparency.

Example of Alcohol Excise Tax Calculation

If a bottle of vodka has an excise tax rate of 50,000 UZS per liter, then a 0.5-liter bottle sold in a restaurant would be taxed:

- 50,000 UZS × 0.5 liters = 25,000 UZS excise tax

- This amount is added to the final price paid by the customer.

How Tobacco Taxes Affect Restaurants

If a restaurant sells tobacco products, such as cigarettes, cigars, or shisha (hookah), it must comply with excise tax laws for tobacco sales. The key rules include:

- Tobacco excise tax is charged per unit (per pack of cigarettes or per gram for shisha tobacco).

- Higher tax rates apply to imported tobacco products compared to local brands.

- Excise tax is applied before VAT, meaning both taxes are calculated separately.

- Tobacco sales require a special permit, which must be renewed annually.

Example of Tobacco Excise Tax Calculation

For a pack of cigarettes with an excise tax rate of 5,000 UZS per pack, if a restaurant sells 100 packs per month, the total excise tax payable would be:

- 5,000 UZS × 100 packs = 500,000 UZS excise tax per month

Compliance Requirements for Excise Tax

To avoid penalties and maintain legal operations, restaurants selling alcohol or tobacco must:

- Register with tax authorities for excise tax compliance.

- Apply for and renew sales permits for alcohol and tobacco annually.

- Maintain detailed records of sales and tax payments to ensure accurate reporting.

- Submit excise tax filings on time to avoid fines or business restrictions.

By properly managing excise tax obligations, restaurant owners can legally offer alcoholic beverages and tobacco while maintaining profitability and avoiding regulatory issues.

Import Duties and Taxes on Food and Equipment

Many restaurants in Uzbekistan rely on imported ingredients, beverages, and kitchen equipment to maintain high-quality service. However, importing goods comes with additional tax obligations, including customs duties, VAT on imports, and special tariffs on certain products. Understanding these costs helps restaurant owners make informed purchasing decisions and manage expenses efficiently.

Customs Duties on Imported Ingredients

Restaurants that import food products must pay customs duties based on the type of ingredient and its country of origin. The key points include:

- Customs duty rates vary depending on the product category:

- Meat, poultry, and seafood – Higher import duties due to local agricultural protections.

- Dairy products and cheeses – Subject to moderate tariffs.

- Fruits, vegetables, and spices – Some items may qualify for lower tariffs or exemptions.

- Specialty items (truffles, caviar, saffron, etc.) – Often have luxury tax rates.

- Most food imports are also subject to VAT at the standard rate of 12%, calculated on the total cost, including customs duties.

- Exemptions or lower tariffs may apply if the items come from countries with trade agreements with Uzbekistan.

Example of Food Import Tax Calculation

If a restaurant imports 50 kg of premium cheese at a cost of 500,000 UZS per kg, with a customs duty rate of 10%, the tax calculation would be:

- Customs duty: (50 kg × 500,000 UZS) × 10% = 2,500,000 UZS

- VAT on the total value after duty: [(50 × 500,000) + 2,500,000] × 12% = 3,300,000 UZS

- Total tax payable: 5,800,000 UZS

Tax Implications for Imported Kitchen Equipment

Restaurants often import specialized kitchen equipment such as ovens, refrigerators, and espresso machines. These imports also incur taxes and duties.

- Equipment is classified under different tariff codes, each with its own import duty rate.

- Customs duties on kitchen appliances typically range from 5% to 15% of the equipment’s value.

- Imported equipment is also subject to VAT at 12%.

- Second-hand or refurbished equipment may have different tax rates compared to new equipment.

Cost Example for Imported Equipment

A restaurant imports an industrial pizza oven for 20,000,000 UZS with a customs duty rate of 8%:

- Customs duty: 20,000,000 × 8% = 1,600,000 UZS

- VAT on total value after duty: (20,000,000 + 1,600,000) × 12% = 2,592,000 UZS

- Total tax payable: 4,192,000 UZS

How to Reduce Import Costs and Duties

To optimize costs, restaurant owners can:

- Source ingredients and equipment from local suppliers to avoid import taxes.

- Check for tariff exemptions and trade agreements that reduce import duties.

- Use bonded warehouses to defer tax payments until items are sold.

- Buy equipment from approved distributors to avoid excessive customs fees.

By managing import duties strategically, restaurants can reduce costs while maintaining access to high-quality products and equipment.

Tax Incentives and Exemptions for Restaurants

To encourage business growth and economic development, the Uzbekistan government offers various tax incentives and exemptions for restaurants. These benefits help reduce financial burdens, promote investment, and support small businesses in the food and hospitality sector. Understanding these incentives can help restaurant owners legally lower their tax liabilities and improve profitability.

Available Tax Benefits for Restaurant Owners

Restaurants in Uzbekistan may qualify for several tax relief programs, depending on their business size, location, and industry focus. The key tax benefits include:

- Tax Exemptions for Small Businesses

- Restaurants classified as micro or small businesses may be eligible for reduced tax rates or exemptions from corporate income tax.

- Businesses with an annual revenue below a certain threshold may opt for a turnover tax instead of the standard corporate tax.

- VAT Exemptions on Specific Food Items

- Some essential food products (e.g., basic grains, dairy, and certain locally produced goods) may be exempt from VAT.

- Restaurants that serve VAT-exempt food products can apply for partial VAT relief on related transactions.

- Reduced Tax Rates for Restaurants in Free Economic Zones (FEZs)

- Restaurants established in designated Free Economic Zones (FEZs) may benefit from lower corporate tax rates, reduced customs duties, and VAT exemptions.

- These zones are designed to attract investment and tourism, offering long-term tax benefits.

- Tax Deductions on Employee Training and Development

- Restaurants that invest in staff training, culinary courses, or food safety programs may be able to deduct these expenses from taxable income.

How to Qualify for Tax Incentives?

While tax incentives offer financial relief, restaurants must meet specific eligibility criteria and follow the proper application process. Steps to qualify include:

- Register for the correct tax regime

- Determine if your restaurant qualifies as a small business, FEZ establishment, or VAT-exempt entity.

- Apply for the appropriate tax classification with the State Tax Committee.

- Maintain Proper Financial Records

- Ensure that all business transactions, purchases, and payroll records are documented correctly.

- Keep receipts and invoices for VAT-exempt purchases to claim deductions.

- Apply for Exemptions Through Government Authorities

- Submit an application to the local tax office or relevant economic authorities.

- Provide required documents, such as financial statements, tax returns, and proof of eligibility.

- Regularly Check for Policy Updates

- Tax incentives are subject to government policy changes, so it’s crucial to stay informed about new exemptions or modifications to existing benefits.

Common Challenges in Securing Tax Relief

Some restaurants face difficulties when applying for tax incentives due to:

- Lack of awareness – Many business owners are unaware of the available tax benefits.

- Complex application processes – Some exemptions require extensive paperwork and government approvals.

- Failure to meet compliance standards – Businesses with incomplete financial records or tax debts may lose eligibility for exemptions.

To maximize tax savings, restaurant owners should consult a tax professional to navigate the application process and ensure compliance with government regulations. Taking advantage of available incentives can lead to significant cost reductions and greater business sustainability.

How to Stay Compliant with Uzbekistan’s Tax Laws?

Complying with Uzbekistan’s tax regulations is crucial for restaurant owners to avoid fines, business disruptions, and legal issues. Proper tax management ensures smooth operations, financial stability, and long-term success. Understanding common tax mistakes and adopting best practices can help restaurant owners maintain compliance effortlessly.

Common Tax Compliance Mistakes

Many restaurant owners unknowingly make tax-related errors that can result in penalties. The most frequent mistakes include:

- Late or Incorrect Tax Filings

- Corporate income tax, VAT, payroll taxes, and excise taxes must be filed on time to avoid fines.

- Incorrect tax calculations can trigger audits and additional fees.

- Failure to Register for VAT

- Restaurants exceeding the 1 billion UZS annual revenue threshold must register for VAT.

- Delayed registration results in back taxes and penalties.

- Poor Payroll Tax Management

- Incorrectly calculating employee income tax and social contributions can lead to disputes with tax authorities.

- Failure to submit payroll tax deductions on time results in fines.

- Inaccurate Financial Records

- Not keeping receipts, invoices, and tax documents organized makes it difficult to justify deductions.

- Tax audits may lead to additional tax assessments if records are incomplete.

Working with an Accountant or Tax Consultant

Hiring a professional accountant or tax consultant can help restaurant owners stay compliant and optimize tax payments. The benefits include:

- Accurate Tax Filings – Ensures timely and correct submission of tax returns.

- Optimized Tax Strategies – Identifies tax deductions and incentives to lower liabilities.

- Audit Preparedness – Maintains detailed financial records to prevent issues during tax audits.

Best Practices for Staying Tax Compliant

To avoid tax-related problems, restaurant owners should adopt the following best practices:

- Keep Digital and Physical Records

- Maintain detailed sales records, invoices, and receipts.

- Use accounting software to track income, expenses, and tax payments.

- Set Reminders for Tax Deadlines

- Use a tax calendar to keep track of filing dates for VAT, corporate tax, payroll tax, and excise duties.

- Automate tax payments when possible to avoid delays.

- Stay Updated on Tax Law Changes

- Tax policies in Uzbekistan can change periodically, affecting rates and regulations.

- Follow updates from the State Tax Committee of Uzbekistan.

- Conduct Internal Tax Reviews

- Regularly check financial reports and tax filings for accuracy.

- Correct errors before they lead to fines or penalties.

By implementing these compliance strategies, restaurant owners can minimize tax risks, avoid penalties, and ensure financial stability while focusing on growing their business.

Frequently Asked Questions About Restaurant Taxes in Uzbekistan

Many restaurant owners in Uzbekistan have questions about tax obligations, filing procedures, and exemptions. Below are answers to some of the most common inquiries.

Do small restaurants need to register for VAT?

- Restaurants with annual revenue below 1 billion UZS are not required to register for VAT.

- If revenue exceeds this threshold, VAT registration is mandatory.

- Voluntary VAT registration is possible for businesses below the threshold to claim input VAT deductions.

How often do restaurant owners need to file taxes?

- Corporate income tax – Filed annually, with quarterly advance payments.

- VAT returns – Filed monthly, by the 20th of each month.

- Payroll taxes – Submitted monthly, by the 15th of the following month.

- Excise tax on alcohol/tobacco – Filed monthly, along with VAT returns.

Are there any tax benefits for opening a restaurant in a Free Economic Zone (FEZ)?

- Yes, restaurants operating in Free Economic Zones (FEZs) may benefit from:

- Reduced corporate income tax rates.

- Exemptions from import duties and VAT on specific goods.

- Lower property taxes and business licensing fees.

- Eligibility depends on business registration and location within an approved FEZ.

What happens if a restaurant fails to pay taxes on time?

- Late payment penalties – Interest charges apply for overdue taxes.

- Fines for non-compliance – Repeated violations may lead to additional financial penalties.

- Business suspension – Severe tax violations can result in a temporary or permanent closure by authorities.

Can restaurants deduct expenses from taxable income?

- Yes, allowable deductions include:

- Cost of food, beverages, and raw materials.

- Employee wages and payroll contributions.

- Rent, utilities, and operational expenses.

- Marketing and advertising costs.

- Depreciation of equipment and furniture.

- Keeping detailed records and receipts is essential for claiming deductions.

Do restaurants have to pay property tax if they rent their space?

- If the restaurant owns the property, it must pay property tax (2% of cadastral value).

- If renting, the landlord typically pays property tax, but costs may be included in the rent.

Is there a special tax for restaurants in tourist areas?

- Some tourist-heavy cities may impose additional hospitality taxes or local service fees.

- Signage and advertising taxes may also be higher in high-traffic areas.

- Always check with local municipal offices for city-specific taxes.

Where can restaurant owners get tax assistance in Uzbekistan?

- State Tax Committee of Uzbekistan – Official government tax authority.

- Licensed accountants and tax consultants – Help with tax planning and compliance.

- Online tax portals – Provide filing tools and tax law updates.

By understanding and addressing these common tax concerns, restaurant owners can ensure compliance, reduce liabilities, and improve financial stability.

Key Takeaways

Managing taxes is a crucial part of running a successful restaurant in Uzbekistan. From corporate income tax to VAT, payroll taxes, and excise duties, restaurant owners must ensure compliance while optimizing financial strategies. Here are the most important points to remember:

- Corporate Income Tax: Standard tax rate is 15% on net profits, with simplified tax options available for small businesses.

- Value-Added Tax (VAT): Restaurants must register for VAT if annual revenue exceeds 1 billion UZS, with a 12% VAT rate applied to sales.

- Payroll Taxes: Employers must withhold 12% income tax from salaries and contribute to social security and pension funds.

- Local and Municipal Taxes: Restaurants must pay property tax (2%), business license fees, and advertising/signboard taxes depending on location.

- Excise Tax on Alcohol and Tobacco: Additional taxes apply to alcoholic beverages and tobacco products, requiring special permits.

- Import Duties on Food and Equipment: Custom duties and VAT apply to imported goods, with tax-exemptions available in Free Economic Zones (FEZs).

- Tax Incentives: Small businesses, FEZ-registered restaurants, and certain food products may qualify for exemptions or reduced tax rates.

- Compliance Best Practices: Keeping detailed financial records, filing taxes on time, and consulting tax professionals can prevent costly fines and ensure smooth operations.

Staying informed about tax obligations and leveraging available incentives can help restaurant owners reduce costs, increase profitability, and maintain a compliant, financially stable business.

Frequently Asked Questions for Restaurant Owners in Uzbekistan

Discover quick answers to common queries about the taxes that restaurants in Uzbekistan face—designed to improve your visibility online and help readers grasp key tax responsibilities at a glance.

What types of taxes must restaurants in Uzbekistan pay?

Restaurants operating in Uzbekistan are responsible for several types of taxes, including a 12 % VAT on sales (if their annual turnover exceeds 1 billion UZS), 15 % corporate income tax, payroll-related income tax (12 %) plus social security and pension contributions, property tax (approximately 2 %), business license and advertising (signboard) taxes, excise duties on alcohol/tobacco, and import duties and VAT on imported goods.

At what revenue threshold are restaurants required to register for VAT?

A restaurant must register for VAT once its annual revenue exceeds 1 billion UZS. The standard VAT rate applied thereafter is 12 %.

Are there any tax benefits for restaurants operating in Free Economic Zones (FEZs)?

Yes. Businesses registered in FEZs may enjoy tax exemptions on land tax, income tax, property tax, unified small-business tax, and customs duties on qualifying inputs. The duration of these incentives ranges from 3 to 10 years, depending on the level of foreign investment.

Are there special incentives or support measures available for restaurants?

Recent support measures include a halved profit tax for restaurants that switch to paying VAT starting December 1, 2024. Additionally, streamlined operations—such as simplified purchasing documentation for agricultural inputs—have been implemented to ease compliance.

How can restaurant owners stay informed about local or municipal tax obligations?

Tax obligations such as property tax, licensing fees, advertising/signboard tax, and import-related duties often vary by location. Restaurant operators should consult with their local municipal tax office, engage a professional tax advisor, and review lease agreements to understand who bears responsibility for specific taxes.

ABOUT THE AUTHOR

Erkin Coban

Your Customers Deserve The Best

And we got Menuviel for them.

The fastest and easy-to-use online QR menu with 12+ unique features. Choose Menuviel and elevate your service quality to the next level.

Use free for the first 30 days.

In This Article

Free AI Tools for Restaurants

TRY NOW ➜

Enjoy discounted prices for Uzbekistan

We adjust our subscription price for Uzbekistan, so you enjoy all the same great features at a lower, affordable rate.